Beyond Gas. The risks of Fertilizer Dependence for the EU

Surge in Russian fertilizer imports in the EU

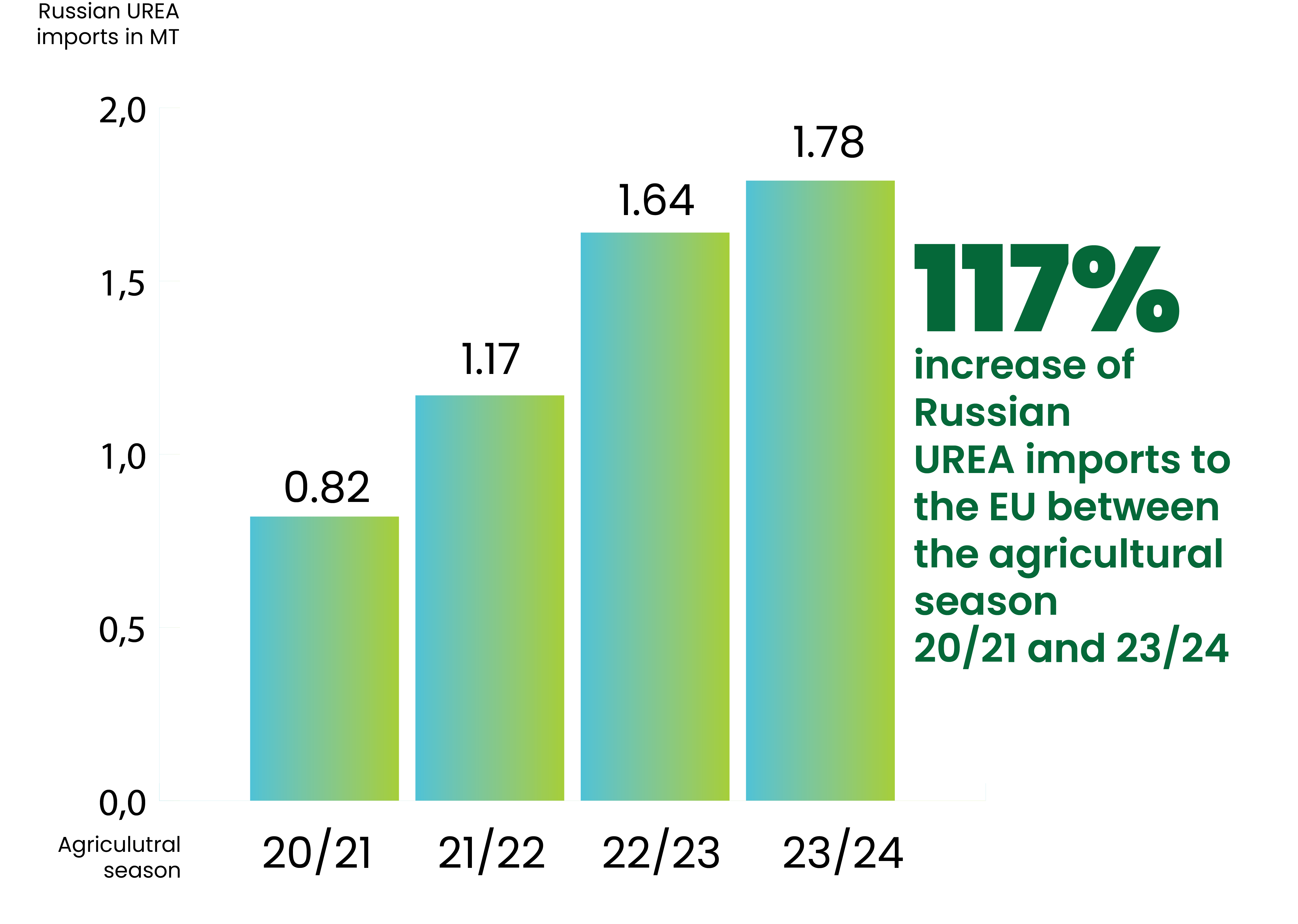

Between the agricultural season 20/21 and 23/24, imports from Russia increased by 117% amounting to 1.78 MT in 23/24.

European farmers are progressively reliant on fertilizers that fall short of meeting high production standards aimed at curbing carbon emissions and promoting environmentally friendly alternatives.

EU Imports of Russian fertilizer financing the war

On 1 October 2023, Russia introduced a temporary export duty for fertilizers of up to 10% with the specific aim of financing the war effort.

Whereas Europe reduced its dependency on Russian pipeline gas, we are now importing Russian gas in a form of nitrogen fertilizer. Moreover, on January 1, 2024, the law on tax on excess profits in the Russian Federation entered into force. The Ministry of Finance of the Russian Federation announced that for 2023 the budget received nearly 3.15 billion EUR from excess profits, of which €600 million (20%) were generated by imports of fertilizers.

This means that every tonne of fertilizer exported to the EU is contributing directly to financing the war in Ukraine.

A stronG agri-food system in eu key for EU Strategic Autonomy

The EU is in the process of decoupling its economy from Russian gas as a matter of European security and strategic autonomy. Yet, the EU risks becoming increasingly dependent on Russian fertilizers, which is gas in the form of feedstock.

This increasing dependency on Russian raw materials is threatening the security and affordability of EU’s food supply, leading to the weaponization of resources from the Russian regime. The latter, as already shown in the case of natural gas, cannot be treated as a reliable partner, especially when it comes to strategic sectors such as agriculture.

Boosting Domestic, Low-Carbon Fertilizer Production in the EU

The EU should introduce measures that guarantee autonomy and independence from Russian inputs and invest in low-carbon domestic production of fertilizer, in line with the EU Green Deal objectives.

The EU fertilizer industry has the necessary capacity to supply nitrogen fertilizers to EU farmers.

EU fertilizers producers have the necessary capacity to ensure EU farmers have access to nitrogen fertilizers, without having to rely on Russian urea imports. In 2022, the total EU- 27 consumption of nutrients was 16mt, of which around 9.3mt was attributed to nitrogen fertilizers. The EU’s total production capacity is 14.8 million. The European market is an open market and the imported products’ share of EU consumption is historically around 32% of the EU’s demand.

The EU fertilizer production facilities are strategically positioned across the European Union and are strategically best placed to supply local farmers with high-quality nutrients .

The impact of the energy crisis on the EU fertilizer industry

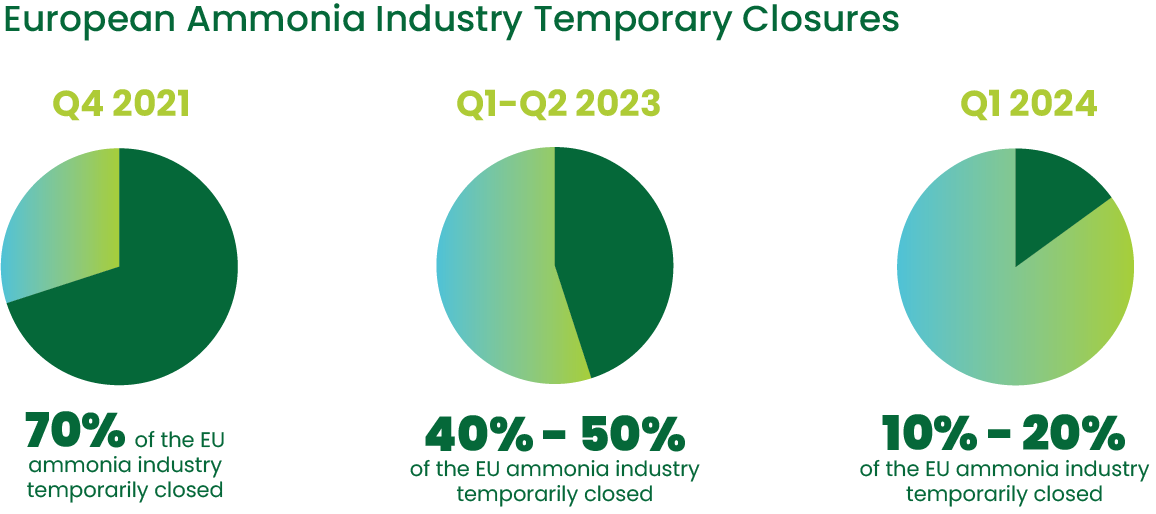

This massive increase in imports of Russian fertilizers has been detrimental the EU’s industry which had already been suffering from an unprecedent surge in natural gas prices. 70% of the EU ammonia industry temporarily closed in September 2021. At the beginning of 2023, 40-50% of total EU ammonia plants were still shut down and only at present the situation is almost going back to normal, though 10-20% of EU production is still suspended. In the past months, EU ammonia plants were also forced into permanent closure. The most significant example is given by BASF’s closure of an ammonia plant in early of 2023, which led to 2,600 people losing their jobs.

Though EU ammonia and fertilizer plants are reopening, the current situation is seriously threatening the sustainability of the EU fertilizer industry in the medium-long term.

Why a Strong European Fertilizer Industry Matters

Ensuring food security

Fertilizers enable 50% of food production, contributing to food security in Europe and beyond. The industry is essential to provide European consumers with nutritious, affordable, and sustainable food, supporting the objectives of the EU Farm to Fork strategy. A strong EU industry is key to ensure the security and affordability of EU’s food supply.

Powering the Hydrogen Economy

The EU fertilizer industry produces about 40% of total European hydrogen as raw material of ammonia production. It is therefore also uniquely placed to contribute to the objectives of the EU Green Deal and the development of a green hydrogen economy in Europe.

Driving Climate Neutrality

The European fertilizer industry is committed to contributing to the decarbonization ambitions in Europe. The industry is already investing in several low-carbon technologies and it has published an ambitious roadmap to transition to climate neutrality. The industry pledges to achieve a substantial 70% reduction in their Scope 1 and 2 greenhouse gas emissions compared to 2020 levels. The ultimate goal is set for 2050, where European fertilizer production aims to be completely climate-neutral.

Supporting EU farmers and sustainable farming

The European fertilizer industry stands by EU farmers as a reliable partner, committed to their success and environmental stewardship. EU-produced fertilizers typically have a smaller carbon footprint compared to the global average, reflecting the industry’s commitment to sustainability. Additionally, a robust, integrated distribution network ensures farmers receive the essential products they need, when they need them.