Priorities

EU ETS/ CBAM

Ensuring a level playing field for fertilizer production, energy and carbon costs is our priority.

Clean Planet for All

Europe’s ambition to be climate neutral by 2050 presents a serious challenge for energy-intensive industries.

Farming & Air Quality

The agricultural sector is responsible for ammonia emissions impacting air quality. A series of best practices can be applied to curb emissions.

By the numbers

The Fertilizer Industry in Europe

9.8

BILLION EURO TURNOVER

66.2

MILLION EURO INVESTED IN R&D BY OUR MEMBERS

75.000

EMPLOYEES

1.4

BILLION EURO ANNUAL INVESTMENT

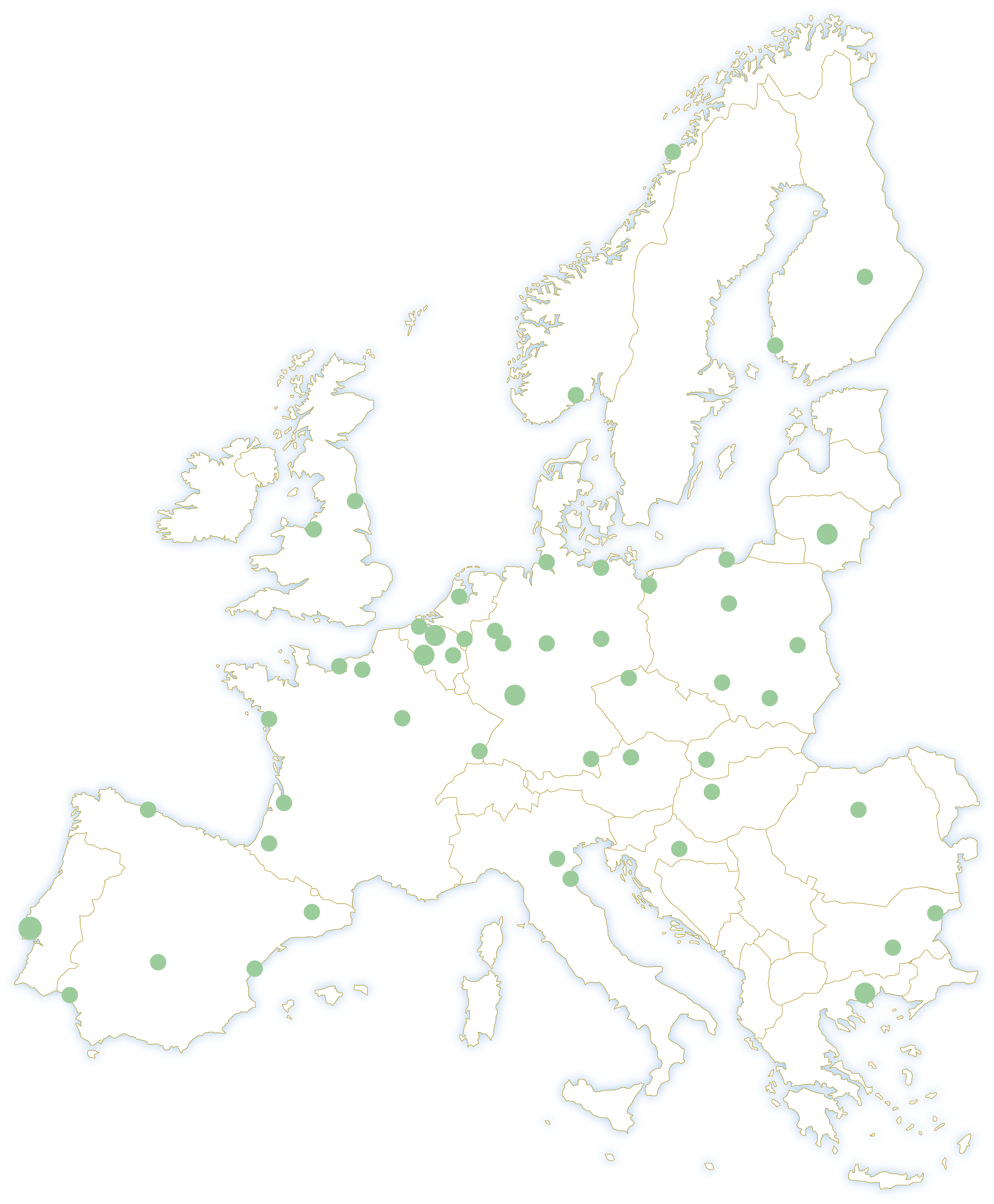

Our association

Fertilizers Europe represents the majority of fertilizer producers in Europe and is recognized as the dedicated industry source of information on mineral fertilizers.

The association communicates with a wide variety of institutions, legislators, stakeholders and members of the public who seek information on fertilizer technology and topics relating to today’s agricultural, environmental and economic challenges.